10 Easy Facts About Insurance Recommendations Choosing The Right Coverage For You Explained

With regards to selecting the suitable insurance coverage coverage, it’s like purchasing a superb set of shoes. You wouldn’t accept something that doesn’t suit just because it appears great, suitable? Properly, the exact same goes for insurance coverage. Insurance policies tips aren't a one-dimensions-matches-all scenario, and finding the correct coverage can be a tricky, still crucial undertaking. The entire process of choosing the proper insurance coverage protection to suit your needs is much more than just investigating rates or checking off a box on the kind. It’s about understanding your needs, challenges, and making certain that the policy you end up picking will present the protection you would like when lifetime throws a curveball.

Some Of Insurance Recommendations Choosing The Right Coverage For You

Enable’s encounter it—nobody would like to think about what may possibly go Incorrect. But that’s just why insurance plan is so essential. Irrespective of whether you’re preserving your property, your overall health, or your automobile, the best protection gives you satisfaction, figuring out which you’re financially organized with the unpredicted. But how do you navigate this sea of possibilities? And just how Did you know which insurance recommendations are certainly value your consideration?

Enable’s encounter it—nobody would like to think about what may possibly go Incorrect. But that’s just why insurance plan is so essential. Irrespective of whether you’re preserving your property, your overall health, or your automobile, the best protection gives you satisfaction, figuring out which you’re financially organized with the unpredicted. But how do you navigate this sea of possibilities? And just how Did you know which insurance recommendations are certainly value your consideration?One of many first actions in deciding on the appropriate insurance plan is working out precisely what you should protect. Would you possess a house or hire? Do you have dependents? Will you be driving a brand new automobile or a thing older? Your Life style plays a huge role in determining the sort of protection that fits you greatest. For example, if you’re a younger Skilled living in a rental, you could only require renters insurance coverage. On the other hand, should you’re a homeowner which has a relatives, you’ll possible have to have homeowners insurance policies with additional protection for things such as legal responsibility or healthcare expenses.

When trying to find insurance policy recommendations, it’s straightforward to get confused through the sheer number of options obtainable. From car or truck insurance plan to life insurance, renters insurance coverage to wellbeing insurance, the checklist can appear to be infinite. But Before you begin finding procedures away from a hat, take a move again and take into account your unique circumstance. Ask on your own, “What pitfalls am I most worried about?” and “What will help me sense protected?” Being aware of your priorities will help you filter out unnecessary solutions and focus on the coverage that really issues.

It’s also important to listen to your fantastic print. Insurance coverage firms are infamous for hiding crucial particulars in complex language. You may be enticed by a reduced premium, nevertheless the plan’s protection boundaries or exclusions could wind up leaving you exposed whenever you want it most. This is where the correct insurance policy recommendations appear into Participate in. A trusted advisor can assist you sift by means of all of the jargon and make sure you’re not lacking critical coverage specifics that can make or break your policy.

A different thing to bear in mind is the significance of shopping about. Just because you’ve been with the very same insurance company For some time doesn’t imply you’re obtaining the finest offer. Premiums, coverage solutions, and customer support can vary tremendously from a single service provider to a different. By comparing quotes and examining the suggestions from diverse providers, it is possible to make sure you’re obtaining the finest value for your money. It would consider a little bit time beyond regulation, though the comfort that comes with knowing you’ve observed the best plan is worth it.

In some cases, the hardest Element of picking out the proper insurance plan is figuring out when to receive extra coverage. Although it’s tempting to go with the bare least and help you save a few bucks, this method can backfire In the long term. By way of example, should you generate an older car or truck, you may think that entire protection isn’t worth it. But what if you get into an accident and end up struggling with high-priced repairs? A primary policy won't go over all The prices, leaving you trapped having a significant bill. That’s why coverage suggestions often suggest opting for a lot more comprehensive protection, even if it expenditures a bit more up entrance.

Whenever you’re thinking of coverage, don’t just think about what’s least expensive. Consider the extended-time period. Often, paying out a little a lot more for coverage which offers extra defense can in fact save you funds In the end by preventing larger out-of-pocket expenses. One example is, though higher-deductible health and fitness designs may appear tempting, they may set you back a lot more in the occasion of the crisis. Equally, an affordable auto insurance policy coverage may well leave you with a lot more costs Should your car is totaled as well as coverage doesn’t totally go over it.

Not known Facts About Insurance Recommendations Choosing The Right Coverage For You

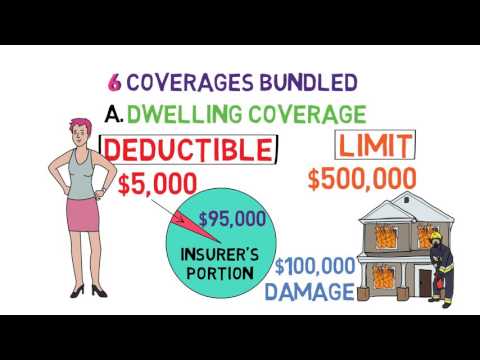

Also, contemplate your deductibles. A deductible may be the amount of money you’ll must pay back out-of-pocket ahead of your coverage kicks in. Insurance coverage suggestions typically recommend selecting a deductible which you can comfortably manage in the event of an unexpected emergency. Although a better deductible might reduced your quality, it could also put you in a tight place financially if you might want to file a claim. Then again, a decreased deductible indicates you’ll pay out better premiums, nevertheless the trade-off is fewer money risk when you have to make use of your insurance policy.Insurance plan can also be about shielding your long term. Existence insurance, By way of example, is something which’s easy to put off for the reason that we’re all active residing our life. But When you have loved ones who depend upon you fiscally, it’s essential to acquire lifetime insurance policy in position. Insurance policy suggestions for all times coverage generally take note of elements like your age, well being, money, and the quantity of dependents you have. This type of coverage makes certain that your family and friends will probably be cared for financially, even if you’re no more close to to supply for them.

Permit’s talk about the strength of bundling. Were you aware that numerous insurance policies providers offer reductions if you mix guidelines like household and car insurance? It’s an easy way to save money without having sacrificing protection. When selecting the appropriate insurance policy coverage, be Get Insights sure to inquire your provider about bundling options. It’s one of the most effective strategies to obtain the protection you will need in a reduce Price. And in nowadays’s aggressive market, insurance coverage corporations are often prepared to present incentives to draw in customers.

But what takes place when your requirements improve? Maybe you’ve purchased a brand new automobile or Your loved ones has developed. Existence functions like marriage, obtaining kids, or purchasing a household can substantially change your coverage prerequisites. In these scenarios, it’s imperative that you revisit your coverage coverage and make changes. Insurance policy tips aren’t static—they must evolve along with your everyday living. A policy that worked for yourself five years in the past will not be ample now, so it’s a good idea to often critique your coverage to make sure it still meets your needs.